what is suta tax rate for 2021

FUTA Tax Rates and Taxable Wage Base Limit for 2021. FUTA tax rates can increase further in increments of 030 per year should loans remain outstanding in subsequent years.

2022 Sui Tax Rates In A Post Covid World Workforce Wise Blog

The FUTA tax rate is 6 on the first 7000 of an employees earnings.

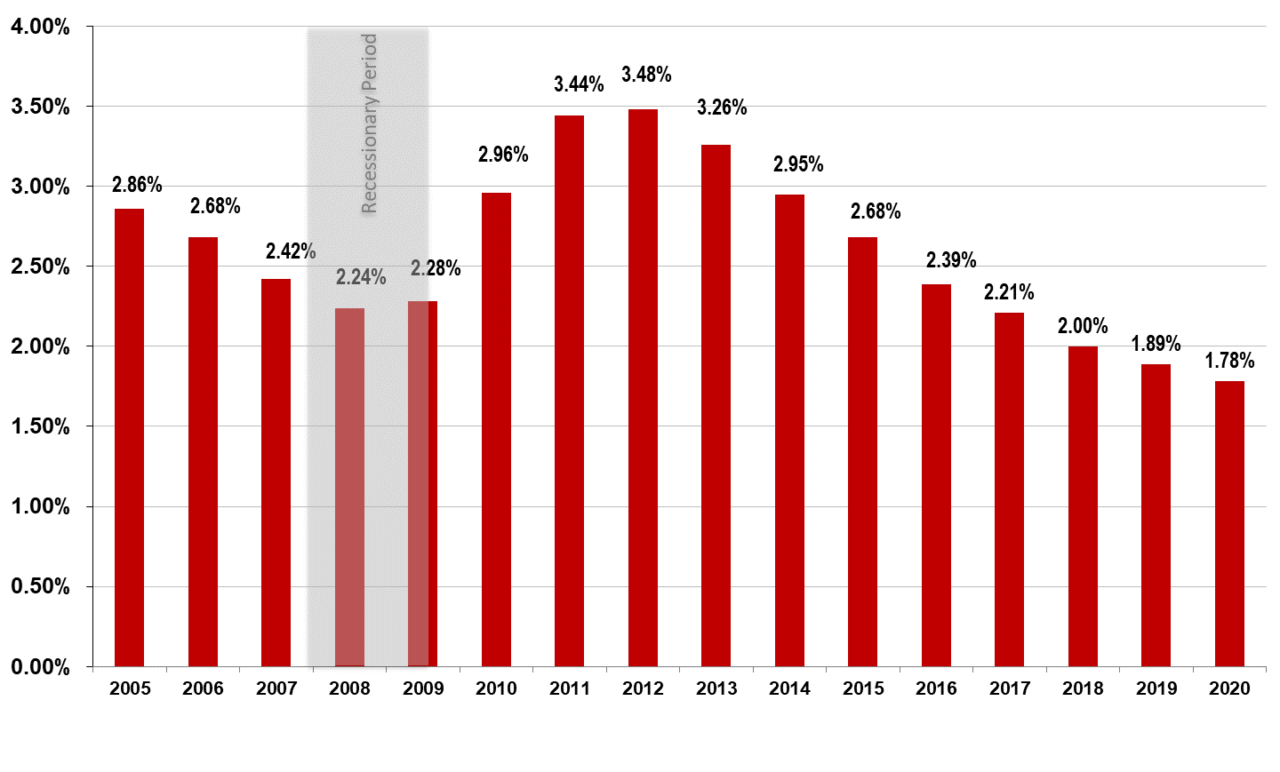

. The impact of COVID-19 on unemployment taxes By January 2021 75 million unemployment claims were filed due to the pandemic. The Office of UC Tax Services plans to issue the Contribution Rate Notice for calendar year 2022 Form UC-657 no later than December 31 2021. Texas law sets an employers tax rate at their NAICS industry average or 27 percent whichever is higher.

The FUTA tax applies to the first 7000 of wages paid to each employee throughout the year. Since your business has. The self-employment tax rate for 2021 is 153 of your net earnings 124 Social Security tax plus 29 Medicare tax.

2021 SUI tax rates. 153 If you work as a company employee your employer typically withholds this from your paycheck as part of payroll taxes. Employers will receive.

By contrast 1099 workers need to account for these taxes on their own. State taxes vary including the State Unemployment Tax Act SUTA contribution rates. If the Office of UC Tax Services issues a denial of a contribution rate appeal the employer has the right to file a second-level appeal with the UC Tax Review Office.

The new law reduces the. The Department mails SUI rate notices Form UC-657 on or before December 31 of each year. From 2021 the FUTA tax rate is 60 and it applies to the first 7000 in annual wages paid per employee.

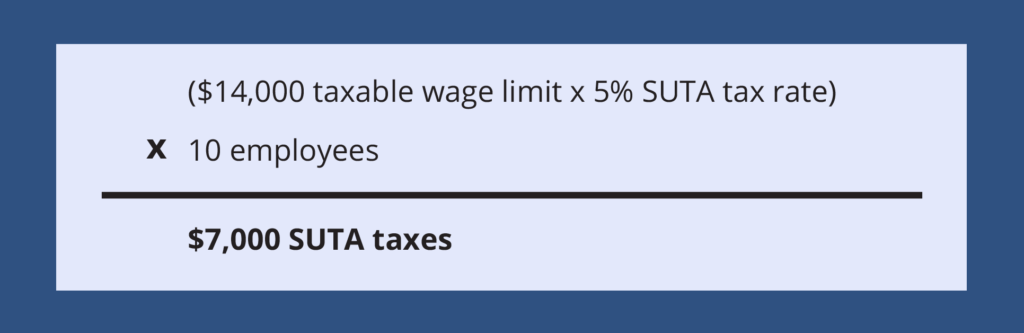

Base Tax Rate for 2022 from 050 to 010. The internal revenue service says its. Please note that tax rates are applicable to the first 14000 each employee earns.

52 rows Most states send employers a new SUTA tax rate each year. 52 rows Each state has a range of SUTA tax rates ranging from 065 to 68. Unemployment Income Rules for Tax Year 2021.

The FUTA tax rate protection for 2021 is 6 as per the IRS standards. Lets say your business is in New York where the lowest SUTA tax rate for 2021 was 2025 and the highest was 9825 and. The first 7000 for each employee will be the taxable wage base limit for FUTA.

If you are a new employer other than a successor to a liable employer you are assigned a tax rate of 20 percent for a minimum of two calendar years. 2021 SDI rates and taxable wage base. After that you may be eligible for a higher or lower tax rate depending on.

Texas law sets an employers tax rate at their NAICS industry average or 27 percent whichever is higher. Lets say your business is in New York where the lowest SUTA tax rate for 2021 was 2025 and the highest was. Employers who have not paid all contributions for the fiscal year ending June 30th may be assessed a delinquent payment surcharge of 10 which is in addition to the overall tax rate.

The 2021 SDI taxable wage base is 128298 up from 122909 for 2020. Additional Assessment for 2022 from 1400 to 000. Most COVID-19 related staff reductions occurred in the second quarter of 2020.

The 2022 payroll tax schedule is a modest shift down from the 2021 tax schedule with an average rate of 197 percent on the first 47700 paid to. The FUTA tax rate is 60 percent. The FUTA tax rate protection for 2021 is 6 as per the IRS standards.

When the United States Department of Labor certifies that the states unemployment compensation program meets federal requirements employers that pay their state unemployment tax on time and in full receive a 54 percent credit to be applied against their FUTA tax rate. For 2022 the minimum overall tax rate is 3 and the maximum overall tax rate is 73. Waiting for your unemployment tax refund about 436000 returns are stuck in the irs system.

Per Departments website the 2021 employee SDI withholding rate which includes disability insurance and paid family leave increases to 12 up from at 10. Base Tax Rate for 2022 from 050 to 010. As noted above the FUTA tax rate is fixed and less variable than SUTA making it easier to estimate your quarterly taxes.

Employers in these states will be subject to a 030 increase in their FUTA tax rate for all of 2022 increasing the rate from 060 to 090. Click here for an historical rate chart. Thats not the case for benefits in 2021.

Some states have their own SUTA wage base limit. The FUTA tax rate is a flat 6 but is reduced to just 06 if its paid on time. I havent received anything.

For experience-rated employers those with three or more years of experience the contribution rate is based on a ratio called the benefit ratio which is determined in such a way that the greater the unemployment caused by the employer the higher the rate. Mailing of 2021 rate notices. Employers in California are subject to a SUTA rate between 15 and 62 and new non-construction businesses pay 34.

Generally states have a range of. Special Assessment Federal Loan Interest Assessment for 2022 from 180 to 000. Unemployment tax rates for employers subject to Oregon payroll tax will move to tax schedule three for the 2022 calendar year.

The SUI taxable wage base continues at 10000 for 2021. The 2021 employee SUI withholding rate remains at 006 on total wages. Once you know your assigned tax rate youll be able to calculate the amount of SUTA tax youll need to pay for each employee.

The states SUTA wage base is 7000 per employee. The new law reduces the amount of unemployment tax and assessments a taxpaying employer will owe in 2022. Newly liable employers continue with the entry-level tax rate until they are chargeable throughout four full calendar quarters.

Employers can access their rate notice information in their UCMS employer portal.

Many Employers Face Higher State Unemployment Insurance Tax Costs Due To Covid 19

Are Employers Responsible For Paying Unemployment Taxes

Federal Unemployment Tax Act Calculation Futa Payroll Tax Calculations Futa Youtube

Suta State Unemployment Taxable Wage Bases Aps Payroll

What Is Sui State Unemployment Insurance Tax Ask Gusto

How Much Does An Employer Pay In Payroll Taxes Payroll Tax Rate

Futa Tax Overview How It Works How To Calculate

What Is Futa An Employer S Guide To Unemployment Tax Bench Accounting

What Is Futa Tax 2021 Tax Rates And Information

Many Employers Face Higher State Unemployment Insurance Tax Costs Due To Covid 19

What S The Cost Of Unemployment Insurance To The Employer

Suta Tax Your Questions Answered Bench Accounting

What Is Futa An Employer S Guide To Unemployment Tax Bench Accounting

State Unemployment Tax Act Suta Tax Rates 123paystubs Youtube

What Is Futa Basics And Examples Of Futa In 2022 Quickbooks

Does Procare Update Futa Or Suta Unemployment Taxes Procare Support

How Severely Will Covid 19 Impact Sui Tax Rates Workforce Wise Blog