what is a real property tax levy

As an investor you may be wondering if its possible to invest in a tax levy. Procedure 699080 and.

How To Calculate Property Tax 10 Steps With Pictures Wikihow

A levy is a legal seizure of your property to satisfy a tax debt.

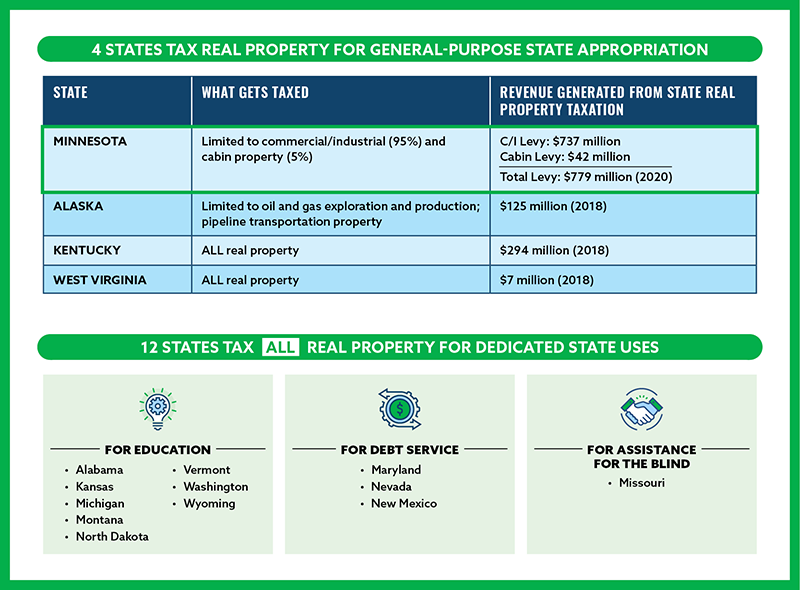

. Property taxes are taxes that are levied from all property owners within a given area based on the value of their property. A levy is a legal seizure of your property to satisfy a tax debt. Property tax levies are imposed only on residents who live in the municipality and own real property whether it is mortgaged or not.

An assessment mill levy is a tax on real property assessed at 1000. What is a Levy. A levy is a legal seizure of your property to satisfy a tax debt.

It can garnish wages take money in your bank or other financial account seize and sell your. Property taxes are calculated by multiplying the assessed value by the mill rate and. Property taxes have always been local governments very own area as a revenue source.

Most commonly property tax is a real estate ad-valorem tax which can. Payments may be made using any of the methods below. Prior to the levy the RPS must open a file.

An IRS levy permits the legal seizure of your property to satisfy a tax debt. What is a mill levy. Voter-approved bond debts cover the repayment of.

Partial payments are not accepted and will be returned. In addition to Levy County and districts such as schools many special districts such as water and. Tax Code Section 5091 requires the Comptrollers office to prepare a list that includes the total tax rate imposed by each taxing unit in this state as reported to the.

California property taxes compose of three types of levies. When you enter data in a search field the data you entered is looked for. Credit reporting agencies may find the Notice of Federal Tax Lien and include it in your credit report.

Property tax is a tax paid on property owned by an individual or other legal entity such as a corporation. So if your home is worth 200000 and your property tax rate is 4 youll pay about. A lien is a legal claim against property to secure payment of the.

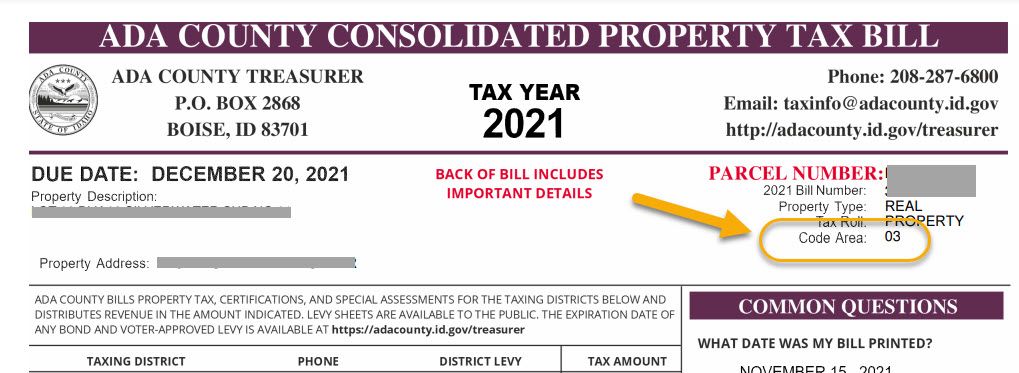

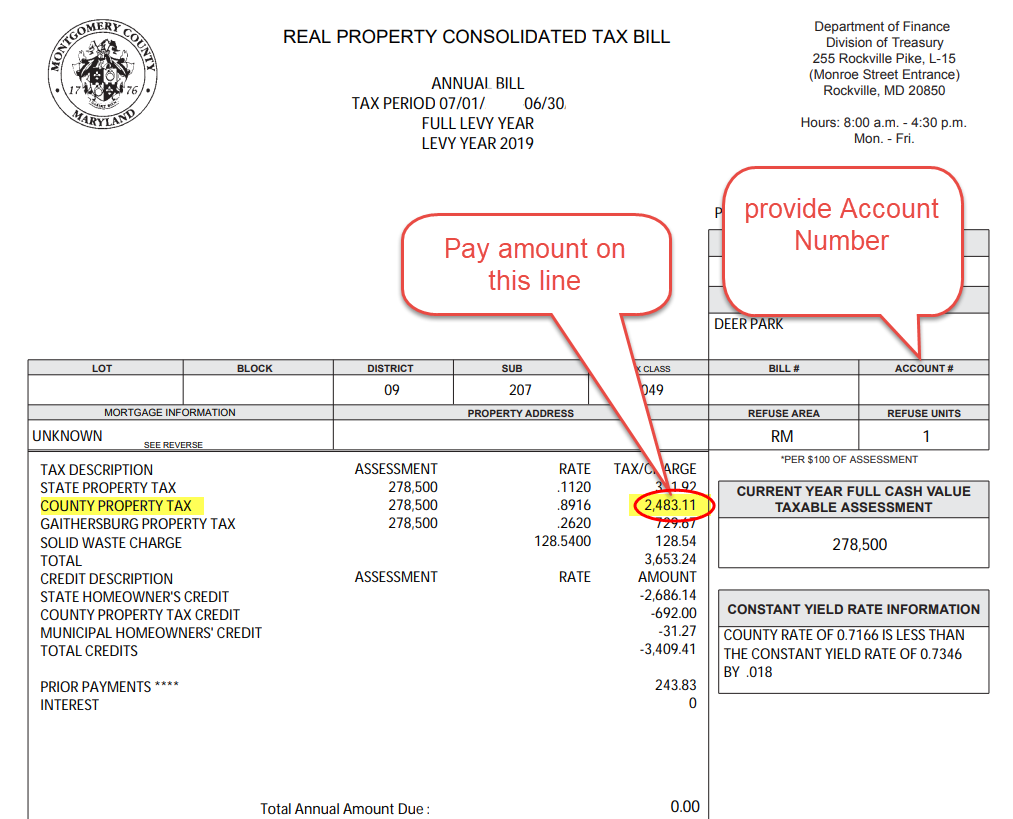

Paying Your Property Tax Bill. Our Office requires real property levies to be served by. A levy rate of 014 rounded to three decimals means you owe 14 of taxes for every 1000 of your propertys taxable value.

Credit reporting agencies may find the Notice of Federal Tax Lien and include it in your credit report. A levy is a legal seizure of your property to satisfy a tax debt. Levies are different from liens.

Tax Rates and Levies. In most places property taxes are paid up to twice. Renters who lease their primary residence are not.

A lien is a legal claim against property to secure payment of the tax debt while a levy actually takes the property to. Heres what you need to know before getting started. A mill levy is the assessed property tax rate used by local governments and other jurisdictions to raise revenue to cover annual expenses.

If you are searching by property address or owner name you may enter any portion of either or both of those fields. General tax levy since 1978 remains at 1 percent of the assessed property value. Levy rates for 2019 in Boise were at their lowest levels in at least.

To estimate your real estate taxes you merely multiply your homes assessed value by the levy. A Registered Process Server RPS per Code of Civil.

Report Minnesota S Tax On Ci Properties

Property Tax Reedsburg Wisconsin

Chart 50 Highest Real Estate Tax Levies By Kentucky School Districts 89 3 Wfpl News Louisville

Understanding California S Property Taxes

Sanpete County Treasurer Sanpete County

The New Age In Indiana Property Tax Assessment

Property Tax Levy Amount Approved Final Vote Nov 18 Village News List Village Of Carol Stream Il

Understanding Your Property Tax Statement Cass County Nd

New York Property Tax Everything You Need To Know

Adjusted Annual Property Tax Bill Los Angeles County Property Tax Portal

Property Tax In The United States Wikipedia

Tax Information Village Of River Forest

Real Property Taxes In Europe European Property Tax Rankings

New York Property Tax Everything You Need To Know