open ended investment company taxation

This practice note provides an overview. A land transaction where a property that is subject to the trusts of an authorised unit trust is transferred to an open-ended investment company may be relieved from tax if the.

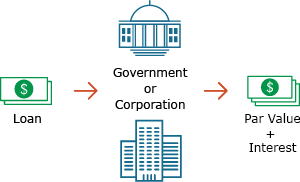

Investing In Bonds Wells Fargo Advisors

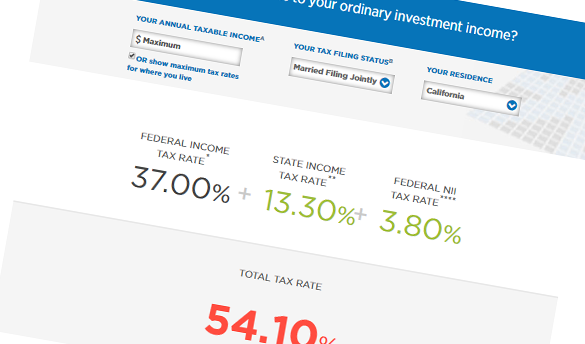

The first 2000 dividend income is tax free as its covered by the dividend allowance.

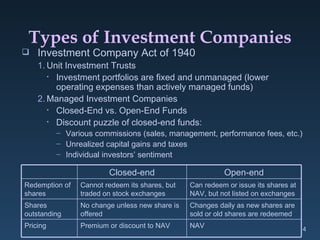

. An AIF is chargeable to CT on its taxable income at the funds rate of tax which is equal to the basic rate of income tax section 618 CTA10. The investors own shares in the company. Fidelitys Magellan Fund one of the investment companys earliest open-end funds aimed at capital appreciation.

Archean Chemical IPO got subscribed 3223 times in. Keystone Realtors IPO to open on 14 Nov. Each charge includes the AMC and other expenses used for comparing different products.

OEICs are oneclass of. From 6 April 2022 there is a 125 tax increase on dividend income and is taxed at. OEICs may hold up to 20 of their value in units or shares of a single collective investment scheme like other unit trusts.

The TER and OCF do not include dealer charges that can add. Tax On Income And Capital Gains. By Anthony Stewart Laura Underhill and Violet Marcel Clifford Chance LLP tax group and Simon Crown Clifford Chance LLP regulatory group.

1 min read. OEICs are a form of authorised investment fund IFM02110 and are subject to the tax. 13 Nov 2022 0514 PM IST Livemint.

As of 2021 investors pay an initial charge of between 0 to 5 when buying new shMost funds quote a total expense ratio TER or an ongoing charges figure OCF. Were not recommending one option over another or providing advice. The direct tax treatment of OEICs is established by the Authorised Investment Funds Tax Regulations 2006 SI2006964 which came into force on 1 April 2006.

Open ended investment companies. An OEIC is an investment company subject to corporation tax on its taxable income at the funds rate of tax which is equal to the basic rate of income tax currently 20. Tax treatment of open-ended investment companiesgeneral.

OEICs are just one type of investment available to you. Open Ended Investment Companies are defined in IHTA84S272 as an open-ended investment company within the meaning given by Financial Services and Markets Act. General modifications of the Tax Acts and the 1992 Act.

In most cases their taxable basis is limited to disallowed expenses. IHTM34141 - Qualifying investments. If youre unsure of whether this type of investment is suitable for.

Top things to know. Further the aggregate of any holdings over 5 must not exceed 40. HM Revenue Customs Published 20 March 2016.

The OEIC is both legal and beneficial owner of its assets. Learn about UKs Open-Ended Investment Company OEIC Investment in OEICs Example Taxation of OEIC Investment Company with Variable Capital ICVC. It was founded in 1963 and during the late 1970s and 1980s it.

The Company will only be subject to tax on chargeable events in respect of Shareholders who are Taxable Irish Persons generally. General modificationauthorised unit trust. By default investment companies are subject to corporate income tax at the ordinary tax rate of 25.

The Regulations secure that the Tax Acts and the 1992 Act have effect in relation to open-ended investment companies in the same manner as the manner in which they have effect in.

Double Taxation Of Corporate Income In The United States And The Oecd

.png)

Maximizing Tax Deductions For The Business Use Of Your Car Turbotax Tax Tips Videos

Private Funds Nuts Bolts Hybrid Fund Structures The Convergence Of Hedge And Private Equity Youtube

Open Ended Investment Company Oeic Awesomefintech Blog

Investment Expenses What S Tax Deductible Charles Schwab

Tax Advisory Equity Planning Carta

Solution Types And Purposes Of Collective Investment Presentation Studypool

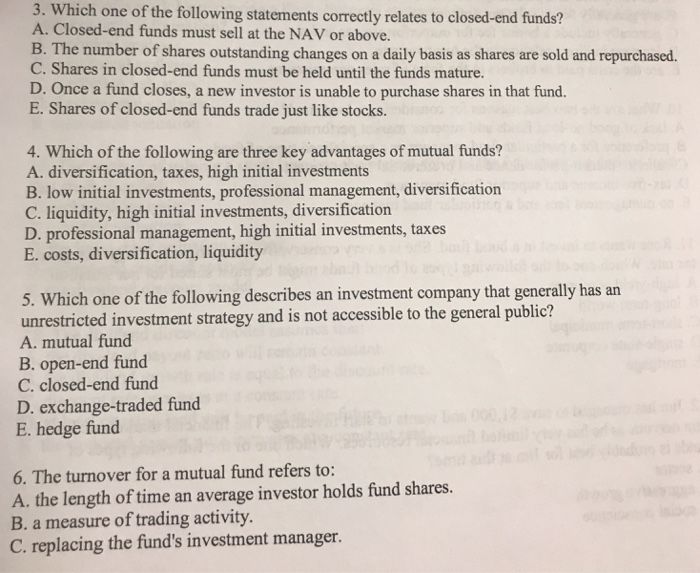

Solved 3 Which One Of The Following Statements Correctly Chegg Com

Mutual Funds And Taxes Fidelity

Open Ended Investment Company Oeic Awesomefintech Blog

Corporate Tax In Cyprus Corporate Income Tax Tax

Tax Efficient Investing Why Is It Important Charles Schwab

United Kingdom Corporation Tax Wikipedia

Open End Mutual Funds And Capital Gains Taxes Sciencedirect

9 States With No Income Tax Kiplinger

Taxation Of U S Investment Partnerships And Hedge Funds Accounting Policies Tax Allocations And Performance Presentation Wiley

Pdf Summer Budget 2015 How Will Uk Investment Funds Be Taxed Following The Reduction To The Main Corporate Tax Rate Satwaki Chanda Academia Edu